Home Equity Lines of Credit (HELOC) can be used to

- Borrow for Home Improvements

- College Tuition

- A New Vehicle

- A Vacation

- Medical Bills

- A Family Wedding

- Starting a Home-Based Business

- Any Number of Other Major Expenditures

- Enjoy interest rates are much lower than what you'd pay on a credit card or personal loan

- Draw only the funds you need, interest accrues only on the amount outstanding

- Interest you pay on a home equity loan can be tax deductible, which further reduces the cost of borrowing*

- Draw on your approved limit for 10 years, with a 15- year re-payment thereafter

- Home Equity Convenience Checks allow easy access to your funds

- No Annual Fees

Home Equity Line of Credit Disclosures

For Equity Access Line of Credit Loan limits up to 80% of the appraised value (Loan to Value or LTV) of your primary or secondary residence, with a maximum of $250,000 and a competitive variable rate tied to Prime

Equity Credit Line Loan limits up to 80% of the appraised value (Loan to Value or LTV) of your primary or secondary residence, with a maximum of $200,000 and a competitive variable rate tied to Prime.

Equity Plus Credit Line With our Equity Plus you can borrow up to 100% of the appraised value (Loan to Value or LTV) of your primary residence, with a maximum of $100,000.

Investor Equity Credit Line If you have Investment Property, this is the credit line for you. Loan limits up to 75% of the appraised value (Loan to Value or LTV) on your Investment (rental) Property, with a maximum of $50,000.

Pros and Cons of Lines vs. Loans

| Description | Pros of Product | Cons of Product | Common Uses of Product |

|---|---|---|---|

| Equity Credit Line (to 80% LTV) |

|

|

|

| Equity Plus Credit Line (to 100% LTV) |

|

|

|

| Fixed Rated Second Loan (to 80% LTV) up to 180 months |

|

|

|

| Term Equity Plus Loan (to 90% LTV) |

|

|

|

| Investor Equity Credit Line (to 70% LTV) |

|

|

• Repairs, upgrades • Pay off bills associated to the rental to keep it separate from their home bills and rental improvements or whatever they want |

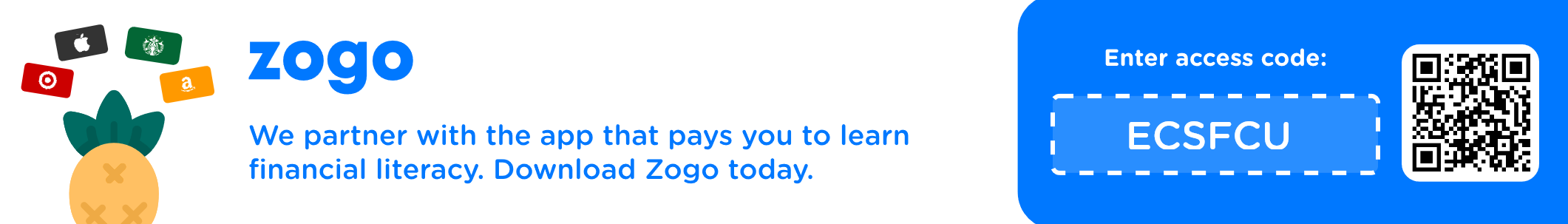

ECSFCU!

ECSFCU!